How to Secure Your Income Tax Returns E-Filing Account

You can secure your income tax returns e-filing account

The Income Tax department’s e-filing website lets you manage all your tax-related matters. This includes filing your income tax returns online, checking the status of your IT refund applications, and to e-verify your IT return. The IT department’s website therefore has a lot sensitive financial information that you probably want to protect. The IT department offers certain options to add to your account’s security and you can use those in order to protect your account. The first step obviously involves using more secure passwords and avoiding passwords you’ve used elsewhere, and once you’ve done that, follow these steps to increase the security of your income tax returns e-filing account.

How to secure income tax returns e-filing account

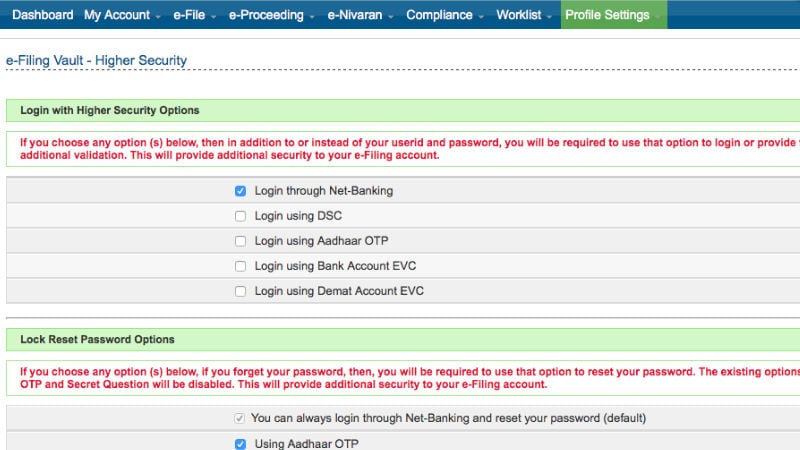

- Go to the Income Tax e-filing website’s Higher Security webpage. You can find this under the Profile Settings tab > e-Filing Vault - Higher Security.

- Now you’ll see two headings — Login with Higher Security Options that lets you add an extra layer of security while logging in and Lock Reset Password Options that prevents changing the password without an extra layer of authentication.

- Under Login with Higher Security Options, select the option you want to enable. We chose Login through Net-Banking for this tutorial. You may also choose from Login using Aadhaar OTP, Login using DSC (digital signature certificate), Login using Bank Account EVC (electronic verification code), and Login using Demat EVC.

- Once you check that option, click Proceed.

- Now you will see a pop-up describing the security method. Click Ok.

- You’ll be back to the page in step 3. Click Proceed again.

- The next page will ask you to confirm your authentication method. Click Confirm.

This will enable the extra step of authentication to your account. When you log in the next time you will be asked to use the second factor of authentication after you enter your income tax e-filing credentials. For net banking based logins, you need to go to your bank’s net banking portal and find the income tax e-filing option. When you select the option labelled something like “E-file your income tax return”, you’ll be able to access your e-filing account. This step varies based on the method of authentication you choose. The DSC method appears to be the most secure as it lets you create a USB token to log in. Detailed instructions on how to use it can be found on the IT department’s Help page > How to > How to Register DSC.

How to lock password reset on income tax e-filing website

It’s easy to lock password resets on the IT department’s e-filing website. Follow these steps.

- Go to the Income Tax e-filing website’s Higher Security webpage.

- Scroll down to Lock Reset Password Options.

- Resetting your password via net banking is always enabled. However, you can prevent resets via other methods such as Using Aadhaar OTP, Upload DSC, Using Bank Account EVC, and Using Demat EVC. We tried Using Aadhaar OTP for this tutorial. Check the option you wish to choose and click Proceed.

- The next step is just a confirmation pop-up. Here click Generate Aadhaar OTP.

- Then the site asks you to enter the OTP. Enter it and click Validate.

- In the next step click Confirm.

This will enable locking password resets without additional authentication. The next time you try to reset your IT e-filing account password, you’ll be asked to enter your Aadhaar OTP, or to use the other authentication method that you chose.

How to Secure Your Income Tax Returns E-Filing Account

![How to Secure Your Income Tax Returns E-Filing Account]() Reviewed by Martin pagire

on

July 18, 2018

Rating:

Reviewed by Martin pagire

on

July 18, 2018

Rating:

No comments: